After a car accident, the immediate question that often arises is: who is responsible? In most states, the principle of fault dictates who pays for the damages. If you can prove another driver was at fault for the crash, their insurance typically covers your losses. However, in no-fault states, things operate differently, especially when it comes to vehicle repairs.

Understanding who pays for car repair in a no-fault crash can be confusing. This guide will clarify how no-fault insurance impacts liability and who is responsible for covering vehicle damage when accidents occur in these states.

Understanding No-Fault Insurance (Personal Injury Protection – PIP)

No-fault insurance, also known as Personal Injury Protection (PIP), is designed to streamline the handling of medical expenses after a car accident. In no-fault states, each driver is generally responsible for their own medical bills, regardless of who caused the accident. This is achieved through PIP coverage, an additional layer of insurance that makes policies in these states typically more expensive than in traditional fault-based states.

For instance, many no-fault states mandate minimum PIP coverage to ensure that medical costs are addressed promptly after an accident. This system was established, in part, to reduce the burden on court systems by limiting personal injury lawsuits. By requiring drivers to carry PIP, the intent is to have insurance cover immediate medical needs, potentially decreasing the need to sue other parties for these costs.

The claim process in a no-fault state for injuries involves working directly with your own insurance provider. You would:

- Notify your insurance company about your injuries from the accident.

- Communicate with your assigned insurance adjuster regarding your claim.

- Provide necessary medical records to document your injuries.

- Submit all expenses related to your injury for reimbursement.

- Negotiate with your insurance company to settle medical bills and lost wage claims, if applicable under your policy.

It’s crucial to note that Personal Injury Protection primarily covers bodily injuries and related financial losses like medical bills and lost wages. It typically does not extend to “pain and suffering” or, crucially, vehicle damage.

No-Fault Benefits: What’s Covered?

No-fault benefits are provided by the insurance company of the vehicle you occupied at the time of the accident—whether you were driving, a passenger, or even a pedestrian struck by a car. A key characteristic of these benefits is that they are paid regardless of who was at fault for causing the accident.

These benefits generally encompass:

- Payment of medical expenses directly related to the accident injuries.

- Coverage for prescription drug costs resulting from the accident.

- Reimbursement for lost wages if you are unable to work due to your injuries.

- Coverage for essential services like housekeeping or transportation to medical appointments, if needed due to accident-related injuries.

It is vital to be aware of a strict deadline: in many no-fault jurisdictions, you usually have only 30 days from the date of the accident to file an application for these no-fault benefits. Missing this deadline could jeopardize your ability to claim these benefits.

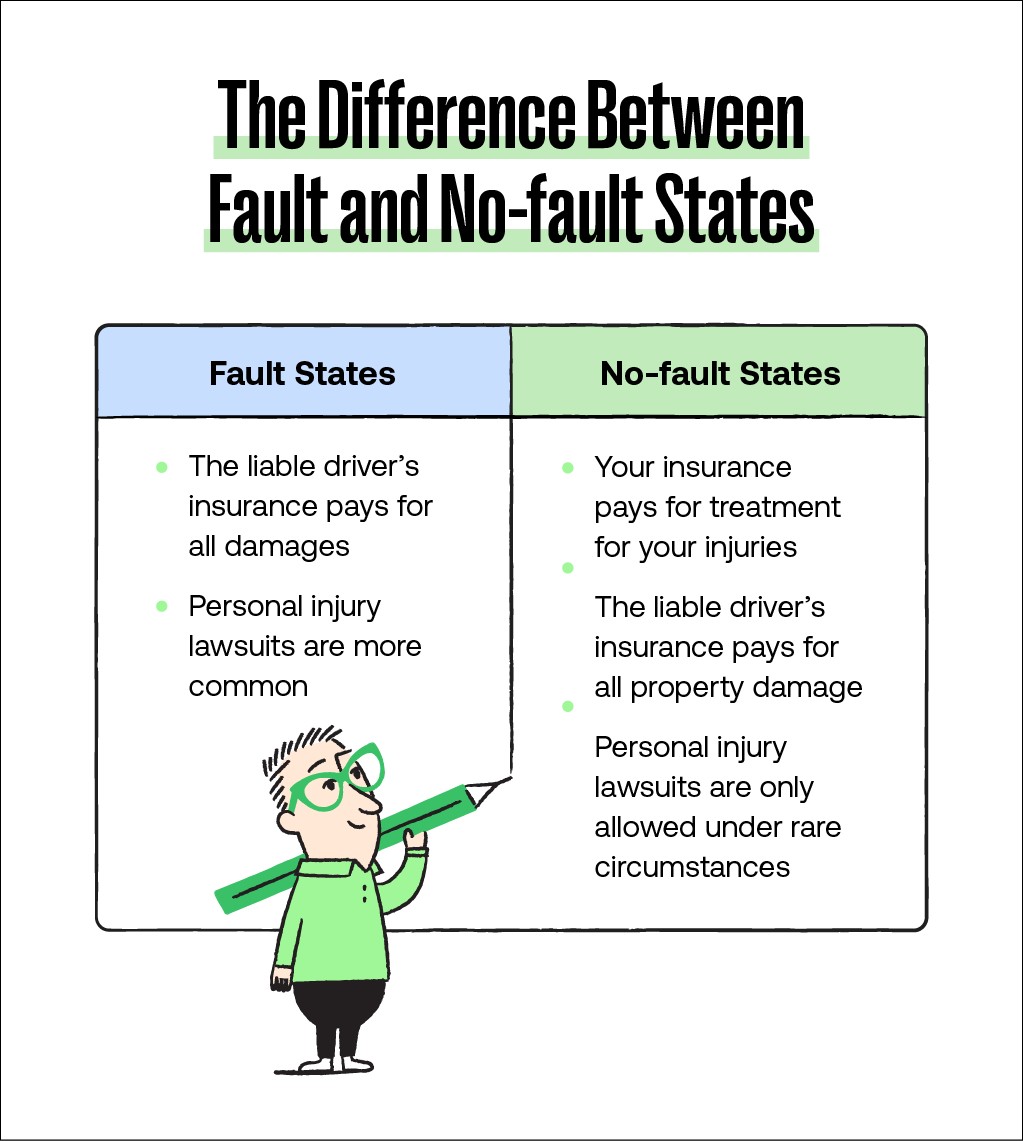

Fault vs. No-Fault States: Understanding the Difference

States that operate under a fault-based system are known as tort states. In these states, the driver determined to be at fault for an accident is legally and financially responsible for the damages to the injured party. This responsibility extends to both medical expenses and vehicle repair costs. Tort states rely on bodily injury liability insurance and property damage liability insurance to cover these costs, rather than Personal Injury Protection (PIP).

No-Fault Insurance States: A State-by-State List

The following states currently operate under a no-fault insurance system:

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Utah

Within this list, Kentucky, New Jersey, and Pennsylvania are categorized as “choice no-fault” states. In these states, drivers have the option to choose whether or not they want to be covered by a no-fault insurance policy. This choice often affects the premiums and the rights to sue after an accident.

Who Pays for Vehicle Damage in a No-Fault State?

While no-fault insurance addresses bodily injuries, it’s important to understand that the system doesn’t absolve at-fault drivers of responsibility for property damage. In no-fault states, the person who is determined to be at fault for causing the accident is still generally liable for the damage to the other driver’s vehicle.

Personal Injury Protection (PIP) in no-fault states is specifically designed to cover:

- Medical bills resulting from accident injuries.

- Necessary out-of-pocket expenses related to medical treatment.

- Lost income due to injury-related inability to work.

- In unfortunate cases, funeral expenses.

- Costs for essential services you cannot perform due to injuries, like childcare or home maintenance.

So, how do you pursue getting your car repaired in a no-fault state if it’s damaged in an accident? Here are the common pathways:

Scenario 1: Utilizing Your Collision or Comprehensive Coverage

One direct approach is to file a claim under your own collision coverage or comprehensive coverage, depending on the nature of the damage to your vehicle.

- Collision coverage is designed to pay for damages to your car resulting from a collision with another vehicle or object. This includes incidents like hitting another car, a guardrail, or a tree.

- Comprehensive coverage covers damages to your vehicle that are not caused by a collision. This typically includes incidents such as theft, vandalism, damage from weather events (like hail or floods), or hitting an animal.

Consulting with your insurance provider is advisable to clarify which coverage applies to your specific accident circumstances. It’s important to remember that both collision and comprehensive coverages are optional and come at an additional premium. Deciding whether these coverages are worthwhile is a personal decision based on risk tolerance and financial planning.

Scenario 2: Pursuing the At-Fault Driver’s Auto Insurance

If the other driver is definitively determined to be at fault for the accident, you have the option to pursue a claim against their property damage liability insurance to cover your car repairs.

The at-fault driver’s insurance company will conduct an investigation to verify their driver’s fault. To strengthen your claim, providing evidence such as a police report that supports your account of the accident, along with photos or videos of the accident scene, can be very helpful.

However, if fault is not clearly established or is disputed, the at-fault driver’s insurance company may resist accepting liability, potentially leading to a more complex claims process.

Scenario 3: Resolving Disputes Through a Lawsuit

In situations where there’s a dispute over coverage or liability, or if negotiations with the insurance companies fail to yield a satisfactory resolution for vehicle damage, filing a lawsuit might be necessary.

Pursuing legal action is more complex than handling claims directly through insurance. Engaging a qualified attorney is strongly recommended to navigate the legal process effectively.

Even in no-fault states, there are circumstances where you can sue the at-fault driver for personal injuries, especially if your injuries meet certain thresholds defined by state law, or if your medical expenses exceed the limits of your PIP coverage. If considering a lawsuit, it’s crucial to address all potential claims, including vehicle damage and personal injuries, from the outset to protect your rights.

How Negligence Affects Liability

Negligence plays a significant role in determining liability in car accidents, even in no-fault scenarios, particularly concerning property damage. When fault isn’t immediately clear, insurance companies investigate the accident to establish a narrative of events and determine the degree of negligence of each party involved.

Different states apply various negligence rules which can significantly affect your ability to recover damages:

- Pure Contributory Negligence: In states following this rule (very few), if you are found to have contributed to the accident in any way—even minimally—you are barred from recovering any damages.

- Pure Comparative Negligence: In these states, you can recover damages even if you were partially at fault for the accident. Your recovery is reduced by your percentage of fault. For example, if you were 30% at fault, you could recover 70% of your damages.

- Modified Comparative Negligence (50% Bar Rule): You can recover damages if you are 50% or less at fault. Your recovery is reduced by your percentage of fault. If you are found to be 51% or more at fault, you cannot recover damages.

- Modified Comparative Negligence (51% Bar Rule): This is similar to the 50% rule, but you can recover damages only if you are 50% or less at fault. If you are 51% or more at fault, you cannot recover anything.

The specific negligence rule applied in your case depends on the laws of the state where the accident occurred.

Suing Another Driver in a No-Fault State

Yes, it is possible to sue another driver in a no-fault state, although there are specific conditions that must be met. While no-fault insurance is intended to reduce personal injury lawsuits, it does not eliminate them entirely.

You may have grounds to sue in a no-fault state if:

- Your medical expenses and lost wages exceed the coverage limits of your PIP insurance.

- The severity of your injuries meets or exceeds the state’s injury threshold, which often involves serious injuries like permanent disfigurement, significant disability, or death.

- The accident has resulted in long-term impacts such as diminished earning potential or future medical expenses that are beyond the scope of PIP coverage.

Suing Third Parties for Additional Damages

In some accidents, responsibility may extend beyond just the involved drivers. If a third party’s actions or negligence contributed to the accident, they can also be held liable.

Examples of third-party involvement include:

- Negligence by an auto repair shop in maintaining a vehicle, leading to a mechanical failure that causes an accident.

- Failure of a local government to properly maintain traffic signals or road conditions, contributing to an accident.

- Debris or obstacles dropped on the road by another vehicle or entity.

- Manufacturing defects in a vehicle part that directly cause an accident.

If a third party contributed to your accident, you may be entitled to pursue additional damages beyond what you might receive from the other drivers involved or your PIP coverage. It’s important to be aware of the statute of limitations for filing lawsuits, which varies by state. Acting promptly is crucial to preserve your right to claim against all responsible parties.

Despite the term “no-fault,” understanding liability is crucial, especially when it comes to vehicle damage. In essence, while no-fault insurance simplifies handling injury claims, responsibility for car repairs in a no-fault state typically falls on the at-fault driver, your own policy’s collision or comprehensive coverage, or through legal action. The “no-fault” aspect primarily concerns personal injuries, not property damage.

FAQs About Car Repair Payment in No-Fault States

Still have questions about who covers car repair in no-fault accidents? Here are some common questions and answers:

Does Insurance Cover Damages If I Am At Fault?

In a tort state, if you are at fault for an accident, your liability insurance generally covers the other party’s bodily injuries and property damage. In no-fault states, your PIP insurance covers your own injuries regardless of fault. However, for vehicle damage in no-fault states, the at-fault driver’s property damage liability should cover the other driver’s car repairs. If you are at fault and need your car repaired, you would typically rely on your collision coverage.

How Do Insurance Companies Determine Fault?

Insurance companies determine fault by applying the traffic laws of the state where the accident occurred and by examining evidence from the accident scene. This often includes reviewing police reports, witness statements, photos, and other relevant information to piece together what happened and who violated traffic laws or acted negligently.

Is a Police Report Automatically Sent to Insurance?

No, police reports are not automatically sent to insurance companies. After an accident, insurance companies will typically request a copy of the police report as part of their investigation into the claim. The police report is a key piece of evidence used by insurers to understand the circumstances of the accident and determine fault, which is essential even in no-fault states for property damage claims.