As of 2024, the automotive repair industry in the United States is a significant market, boasting approximately 290,000 auto repair shops and a staggering total market size of $188.1 billion. If you’re considering entering this lucrative sector, or simply curious about the financial health of the industry, a key question arises: just how much money do car repair shops actually make?

To provide a clear picture of the financial landscape, we’ve delved into the performance data of over 3,300 auto repair businesses across the United States. This analysis, based on publicly available 2023 data, covers a wide spectrum of operations, from independent shops to major franchises like Carstar, Fix Auto USA, and Car-X.

Whether you are exploring business ownership in the auto repair sector or seeking to understand the financial underpinnings of this industry, this article offers an in-depth exploration of the factors that drive revenue, profitability, and the overall return on investment for car repair shops. We will address crucial questions, including:

- What is the average revenue for an auto repair shop?

- What are the typical startup costs associated with opening a car repair shop?

- How profitable are auto repair businesses in today’s market?

Decoding Auto Repair Shop Revenue: How Much Can You Expect to Make?

Our analysis of nearly 2,800 auto repair businesses reveals that the average annual revenue is $1,226,000. This figure serves as a strong indicator of the industry’s potential, but it’s important to understand that revenue figures can fluctuate significantly based on various elements. Location, the range of services offered, and the scale of the business all play a crucial role in determining a shop’s financial intake.

To provide a more granular view, let’s examine the median revenue across different franchise brands:

| Franchise | Number of Businesses | Median Revenue |

|---|---|---|

| Tire Pros | 623 | n.a. |

| Carstar | 430 | $2,265,000 |

| Fix Auto USA | 178 | $2,391,000 |

| Car-X | 145 | $778,000 |

| Merlin Complete Auto Care | 24 | $1,150,000 |

| Tuffy Tire and Auto Service | 163 | $1,344,000 |

| Abra Auto Body & Glass | 57 | n.a. |

| Honest-1 Auto Care | 64 | $1,149,000 |

| Maaco | 398 | $1,281,000 |

| Meineke Car Care Centers | 705 | $897,000 |

| Rad Air Complete Car Care | 10 | $1,102,000 |

| Weighted Average Revenue | 2,797 | $1,225,778 |

*n.a. indicates non-available data due to franchisor disclosure policies.

As the table illustrates, median revenues vary considerably among franchises. Factors such as brand recognition, service specialization (e.g., bodywork vs. general repair), and operational models contribute to these differences. While the weighted average provides a comprehensive overview, prospective shop owners should research specific franchise performance to understand potential earning benchmarks.

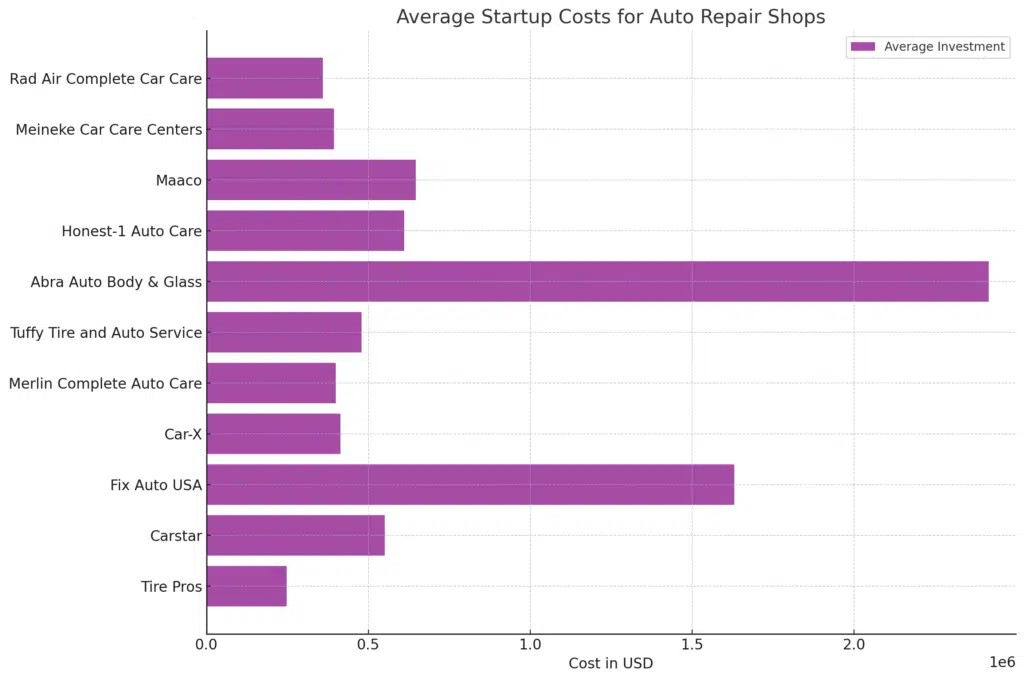

Startup Costs: What Investment is Required to Open an Auto Repair Shop?

The initial investment to launch an auto repair shop typically ranges from $235,000 to $1,348,000. This wide range reflects the diverse scales and business models within the auto repair industry. Several factors influence startup costs, including location, facility size, equipment needs, and franchise fees (if applicable).

Let’s break down the investment ranges based on franchise data:

| Franchise | Low Investment | High Investment |

|---|---|---|

| Tire Pros | $12,000 | $483,000 |

| Carstar | $298,000 | $804,000 |

| Fix Auto USA | $170,000 | $3,090,000 |

| Car-X | $315,000 | $512,000 |

| Merlin Complete Auto Care | $265,000 | $534,000 |

| Tuffy Tire and Auto Service | $229,000 | $729,000 |

| Abra Auto Body & Glass | $264,000 | $4,569,000 |

| Honest-1 Auto Care | $223,000 | $998,000 |

| Maaco | $276,000 | $1,016,000 |

| Meineke Car Care Centers | $227,000 | $562,000 |

| Rad Air Complete Car Care | $146,000 | $573,000 |

| Average Investment | $235,000 | $1,348,000 |

As you can see, the “Tire Pros” franchise presents a notably lower entry point in terms of initial investment, while “Abra Auto Body & Glass” requires a significantly higher capital outlay, especially at the higher end. These differences underline the importance of aligning your investment capacity with the chosen business model and brand.

Detailed Breakdown of Startup Costs for a Medium-Sized Auto Repair Shop ($200,000 – $500,000)

For a clearer understanding of where your investment dollars go, let’s examine the typical startup costs for a medium-sized auto repair business. Budgeting within the $200,000 to $500,000 range generally allows for a well-equipped and professionally operated shop.

- Equipment and Fixtures: This constitutes a significant portion of the startup budget, covering essential tools, lifts, diagnostic equipment, and shop fixtures. Expect to allocate approximately $131,000 – $193,000.

- Inventory: Maintaining an initial stock of essential parts, supplies, and consumables is crucial for immediate service availability. Budget $5,000 – $24,000 for initial inventory.

- Leasehold Improvements: Adapting a leased space to meet the specific needs of an auto repair shop, including bay construction, office build-out, and necessary renovations, can range from $8,000 – $64,000.

- Training Expenses: Investing in pre-opening employee training ensures a skilled and efficient workforce from day one. Allocate $3,000 – $5,000 for initial training programs.

- Pre-Opening Expenses: Various setup costs, including utility deposits, licenses, permits, and initial administrative setups, typically fall within the $10,000 – $20,000 range.

- Grand Opening Advertising: A successful launch requires strategic marketing to attract initial customers. Budget around $7,500 for grand opening advertising and promotional activities.

- Signage: Clear and professional signage is essential for visibility and branding. Costs can range from $20,000 – $100,000 depending on complexity and location.

- Business Licenses and Permits: Securing the necessary legal operating permits and licenses is a mandatory step, with fees typically around $500.

- Real Estate Costs: Initial rental costs for the business premises can vary significantly by location. Budget anywhere from $0 – $30,000 for initial rent, depending on lease terms and deposit requirements.

- Additional Funds (3 months): It’s crucial to have sufficient working capital to cover operating expenses during the initial months before the business becomes consistently profitable. Allocate $10,000 – $50,000 as a financial buffer.

- Insurance (3 months): Protecting your business with comprehensive insurance coverage is essential. Budget $4,000 – $5,000 for the first three months of insurance premiums.

Profitability of Auto Repair Shops: Understanding Your Earning Potential

Auto repair shops generally demonstrate a healthy average operating profit margin of 26%. Operating profit margin is a key performance indicator, reflecting the percentage of revenue remaining after covering operating expenses, but before accounting for taxes and interest. This metric provides a clear view of the core profitability of the business operations.

To gain a deeper insight into profitability, let’s examine key metrics across various auto repair franchises:

Key Profitability Metrics for Auto Repair Franchises

| Franchise | COGS % | Gross Profit % | Labor Costs % | Operating Profit % |

|---|---|---|---|---|

| Car-X | 35.2% | 64.8% | 30.3% | 19.9% |

| Merlin Complete Auto Care | 28.1% | 71.9% | 16.1% | 38.6% |

| Tuffy Tire and Auto Service | 30.8% | 69.2% | 28.2% | 26.3% |

| Meineke Car Care Centers | 26.3% | 73.7% | 19.2% | 24.2% |

| Rad Air Complete Car Care | 25.3% | 74.7% | 24.7% | 21.0% |

| Average | 29.14% | 70.86% | 23.7% | 26.0% |

The data highlights that “Merlin Complete Auto Care” franchises exhibit a notably higher operating profit margin compared to others, while “Car-X” shows a slightly lower margin within this group. These variations can stem from differences in operational efficiency, pricing strategies, service mix, and cost management practices across different franchise systems.

Ongoing Operational Costs: What Expenses to Expect When Running an Auto Repair Shop?

Beyond startup costs, understanding the ongoing expenses is crucial for effective financial management and sustained profitability. The primary operational costs for an auto repair business encompass the cost of goods sold (COGS), labor expenses (both direct and indirect), and general operating expenses.

Here’s a detailed breakdown of typical running costs:

- Cost of Goods Sold (COGS): This represents the direct costs linked to providing repair services, primarily encompassing parts and materials. Typically, COGS can range from 25-35% of total revenue.

- Labor Costs: This includes wages, salaries, benefits, and payroll taxes for technicians, service advisors, and other staff. Labor costs are a significant expense category, usually accounting for 16-30% of revenue.

- Rent and Utilities: The cost of leasing or renting the shop premises, along with essential utilities such as electricity, water, and gas, typically represents 5-10% of revenue.

- Marketing and Advertising: Consistent marketing efforts are essential for customer acquisition and retention. Budget approximately 1-5% of revenue for online advertising, local marketing, and promotional activities.

- Insurance: Maintaining adequate insurance coverage, including general liability, property insurance, workers’ compensation, and garage keepers insurance, is vital. Insurance premiums typically account for 2-4% of revenue.

- Supplies and Equipment Maintenance: Ongoing costs for maintaining and replacing tools and equipment, as well as purchasing consumable supplies, generally range from 2-5% of revenue.

- Administrative Expenses: General overhead costs, including office supplies, accounting services, software subscriptions, and administrative salaries, usually fall within 5-10% of revenue.

- Training and Development: Investing in continuous training to keep technicians updated with evolving automotive technologies and repair techniques is crucial. Allocate 1-3% of revenue for staff training and development.

- Miscellaneous Expenses: This category covers other operational costs that don’t fit into the above categories, such as travel expenses, uniforms, and professional memberships, and generally accounts for 1-3% of revenue.

Example Profit & Loss Scenario: Maaco Auto Repair

To illustrate a real-world example, consider the profit and loss statement of Maaco auto repair shops. In 2024, 398 Maaco businesses, generating approximately $1,340,000 in annual revenue, achieved an operating profit margin of 16.8%.

{{product_image|medium}}

This example provides a tangible illustration of the financial dynamics of a well-established auto repair franchise.

Enhance Your Financial Planning with an Auto Repair Financial Model Template

For those seeking to delve deeper into the financial planning aspects of starting or managing an auto repair shop, utilizing a specialized financial model template can be invaluable.

See the template

Buy

This type of tool provides a structured framework for forecasting revenue, expenses, and profitability over a multi-year period, enabling informed decision-making and strategic business planning.

Auto Repair Financial Model Template | Excel Spreadsheet

Download an expert-built 5-year Excel financial model for your business plan

{{product_image|medium}}

See the template

Buy