Operating an auto repair business is a venture that offers stability and strong potential for profit. People rely heavily on their vehicles, and the need for maintenance and repair is constant, regardless of economic fluctuations. However, this essential service industry comes with inherent risks. Unexpected accidents, property damage, or injuries can occur, potentially leading to significant financial strain. Auto repair business insurance is crucial for protecting your business from these unforeseen events.

This guide will delve into the costs associated with auto repair business insurance, providing you with essential information to make informed decisions about your coverage.

We Will Explore:

- Factors influencing auto repair business insurance costs

- Understanding auto repair business insurance

- Key coverages included in auto repair business insurance

- Common exclusions in auto repair business insurance

- Benefits and risks of insurance coverage

- Essential tips for purchasing insurance

- Frequently asked questions about auto repair business insurance

Decoding Auto Repair Business Insurance Costs

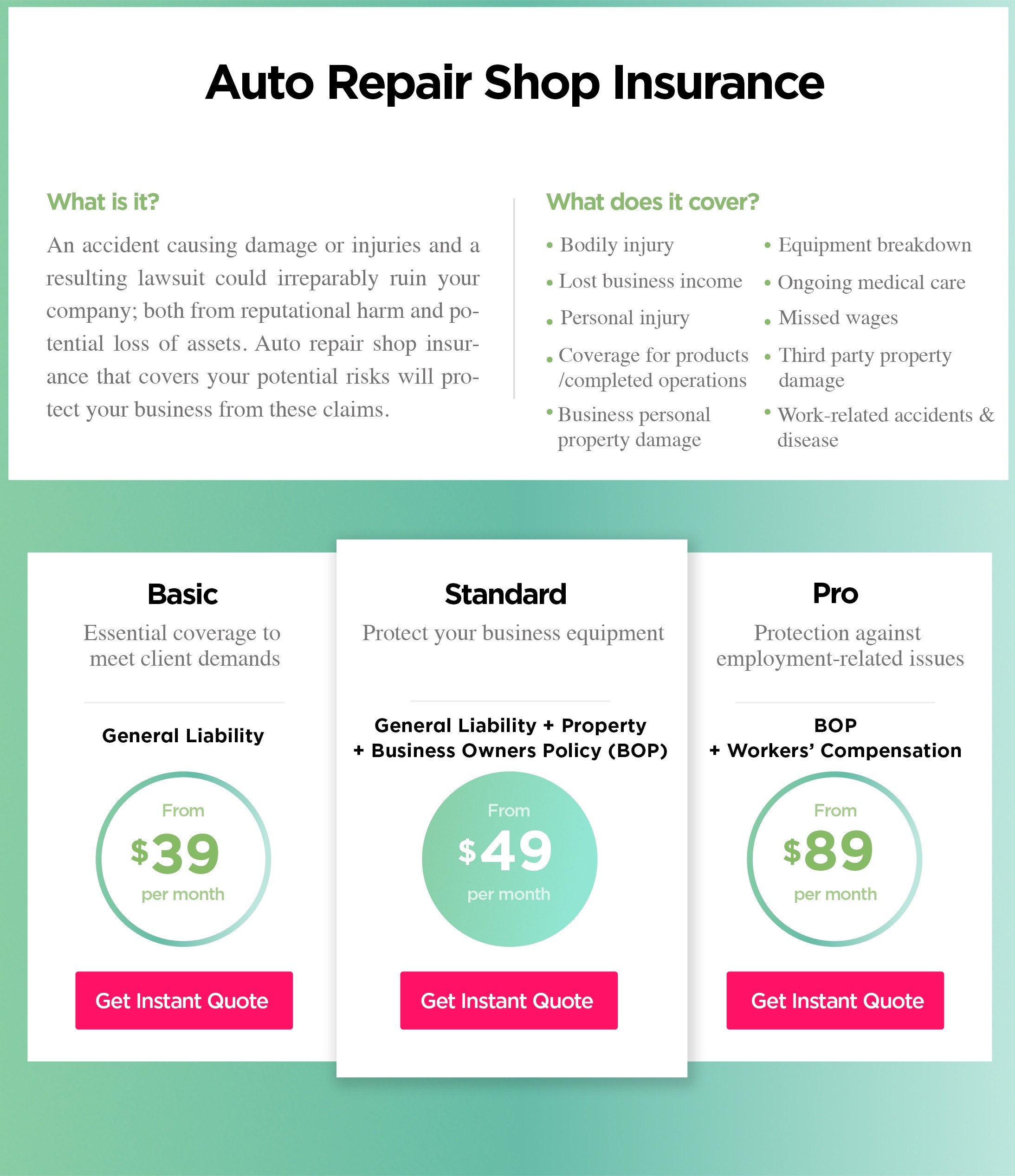

The cost of auto repair business insurance is not a fixed figure. It varies significantly based on several business-specific factors. For a basic policy with limits ranging from $1 million to $2 million, you might expect to pay between $39 and $89 per month. However, businesses requiring more comprehensive coverage or higher liability limits can expect to see these costs increase.

Here’s a visual representation of typical auto repair shop insurance costs:

To accurately determine your specific auto repair business insurance cost, insurers consider factors such as:

- Location: Businesses in areas with higher crime rates or risk of natural disasters may face higher premiums.

- Business Size: Larger shops with more employees and higher revenue typically require more extensive coverage, impacting the cost.

- Payroll: A larger payroll often indicates more employees, increasing potential workers’ compensation claims and thus, insurance costs.

- Annual Sales/Revenue: Higher revenue can signify greater business activity and potential liability, influencing insurance premiums.

- Years in Business & Experience: Established businesses with a proven track record of safety may sometimes receive more favorable rates.

- Types of Services Offered: Specialized services, such as bodywork or работа с hazardous materials, may necessitate additional coverage and affect costs.

What Exactly is Auto Repair Business Insurance?

Auto repair business insurance is a specialized type of commercial insurance designed to protect auto repair shops from the unique risks they face daily. The nature of the work – involving heavy machinery, flammable materials, and customer vehicles – creates numerous opportunities for accidents, injuries, and property damage. Without adequate insurance, a single incident could lead to a lawsuit and significant financial losses, potentially jeopardizing the future of your business. Auto repair business insurance acts as a financial safety net, covering potential liabilities and ensuring the longevity of your shop.

Core Coverages of Auto Repair Business Insurance

While policy specifics vary between providers, a comprehensive auto repair business insurance plan typically includes protection against the following claims:

- Bodily Injury: Covers medical expenses and legal costs if a customer or visitor is injured on your business property.

- Third-Party Property Damage: Protects your business if your operations cause damage to someone else’s property.

- Business Personal Property Damage: Covers damage to your shop’s equipment, tools, inventory, and furniture due to covered events like fire, theft, or vandalism.

- Personal Injury: Protects against claims of libel, slander, or defamation.

- Products/Completed Operations Coverage: Provides coverage if a repair you performed leads to damage or injury after the vehicle leaves your shop.

- Lost Business Income (Business Interruption): Helps replace lost income and cover operating expenses if your shop is temporarily forced to close due to a covered event, like a fire.

- Equipment Breakdown Coverage: Covers the cost to repair or replace essential equipment that breaks down unexpectedly.

- Workers’ Compensation: Covers medical expenses and lost wages for employees who experience work-related injuries or illnesses.

- Ongoing Medical Care: May cover long-term medical care, such as rehabilitation, for injured parties.

- Missed Wages During Recovery: Can compensate injured parties for lost income during their recovery period.

Scenarios Typically Not Covered by Standard Policies

While auto repair business insurance provides broad protection, standard policies usually have exclusions. Common exclusions may include:

- Damage to Customer Vehicles in Your Care, Custody, or Control (CCC): Standard policies often exclude damage to customer vehicles while they are in your shop for repairs. This is where Garage Keepers Liability insurance becomes crucial.

- Employee Dishonesty/Theft: Losses due to employee theft are generally not covered under standard policies and may require separate crime insurance.

- Damage or Injury While Driving Work Vehicles: Commercial auto insurance is needed to cover accidents involving your shop’s vehicles when driven on public roads.

- Errors and Omissions (E&O) / Professional Liability: Incorrect diagnoses or advice leading to further damage are typically not covered by standard policies. E&O insurance addresses this specific risk.

Adding specialized coverages like Garage Keepers Liability, Commercial Auto, and Errors & Omissions insurance can fill these gaps and provide more complete protection.

Benefits and Risks: Why Insurance is Indispensable

The auto repair industry inherently involves numerous risks. From customer injuries on your premises to damage to expensive vehicles, the potential for costly incidents is ever-present. Auto repair business insurance offers vital benefits by mitigating these risks:

- Financial Protection from Lawsuits: Lawsuits can be financially devastating, even if you are not ultimately found liable. Insurance covers legal defense costs and potential settlements or judgments.

- Peace of Mind: Knowing you have adequate insurance allows you to focus on running your business and serving your customers without constant worry about potential financial ruin from unforeseen events.

- Enhanced Customer Trust: Being insured demonstrates professionalism and responsibility, building trust with customers who want to know they are dealing with a reputable and secure business.

- Legal and Contractual Compliance: Many jurisdictions and contracts require auto repair businesses to carry minimum levels of insurance to operate legally.

The primary risk of not having sufficient insurance is financial vulnerability. Without coverage, you are personally and professionally liable for all costs arising from accidents, injuries, and lawsuits, potentially leading to business closure and personal bankruptcy.

Smart Tips for Buying Auto Repair Business Insurance

Navigating the insurance market can be complex. Follow these tips to secure the best coverage at the most competitive auto repair business insurance cost:

- Thorough Risk Assessment: Analyze your specific business operations, considering the size of your shop, services offered, types of vehicles serviced, and location-specific risks to identify all potential liabilities. This assessment will guide your coverage needs.

- Engage an Independent Insurance Agent: Independent agents work with multiple insurance companies and can provide unbiased advice, helping you find the best coverage and rates tailored to your specific needs.

- Obtain and Compare Multiple Quotes: Don’t settle for the first quote you receive. Get quotes from at least three different insurers to compare coverage options, premiums, and deductibles to find the most favorable deal.

FAQ Section

What is a Business Owner’s Policy (BOP)?

A BOP is a bundled insurance package designed for small to medium-sized businesses. It typically combines essential coverages like Commercial General Liability and Commercial Property insurance into a single, often more cost-effective policy.

What is Garage Keepers Liability Insurance?

Garage Keepers Liability insurance is specifically designed for businesses that have temporary custody of customer vehicles for services like repair, maintenance, or parking. It protects you against damage to customer vehicles in your care, custody, or control (CCC) due to covered perils like fire, theft, vandalism, or accidents.

Is Errors & Omissions (E&O) Insurance Necessary?

Yes, Errors & Omissions (E&O) insurance, also known as professional liability insurance, is highly recommended for auto repair businesses. It protects you against claims arising from alleged negligence, mistakes, or failures in your professional services or advice that cause a customer financial harm. For example, if you incorrectly diagnose a problem or fail to recommend a necessary repair leading to further damage, E&O insurance can cover the resulting claims.

In Conclusion

The auto repair and maintenance sector is diverse, encompassing various specialties and business models. Despite these differences, most auto repair businesses share common risks. Auto repair business insurance is not just an expense; it’s a vital investment in protecting your business, your assets, and your future.

Understanding the factors influencing auto repair business insurance costs and carefully assessing your coverage needs are crucial steps in securing a policy that provides robust protection and peace of mind. By taking a proactive approach to insurance, you can ensure your business is safeguarded against unforeseen events, allowing you to focus on providing excellent service to your customers.

Explore Other Essential Insurance Types

| |

|—|—|

| |