Buying a car diagnostic machine on credit can be a smart investment for both professional mechanics and DIY enthusiasts. It allows you to access advanced technology without a large upfront payment, spreading the cost over time. This guide explores the ins and outs of purchasing a car diagnostic machine on credit, helping you make the best decision for your needs and budget.

Understanding Your Diagnostic Needs

Before you even consider buying a car diagnostic machine on credit, it’s crucial to determine your specific requirements. Are you a professional mechanic working on a variety of vehicles, or a DIYer focused on your own car? The type of vehicle you work on (cars, trucks, motorcycles) will influence the type of machine you need. Also, consider the software features, diagnostic capabilities, and future compatibility.

Defining Your Budget

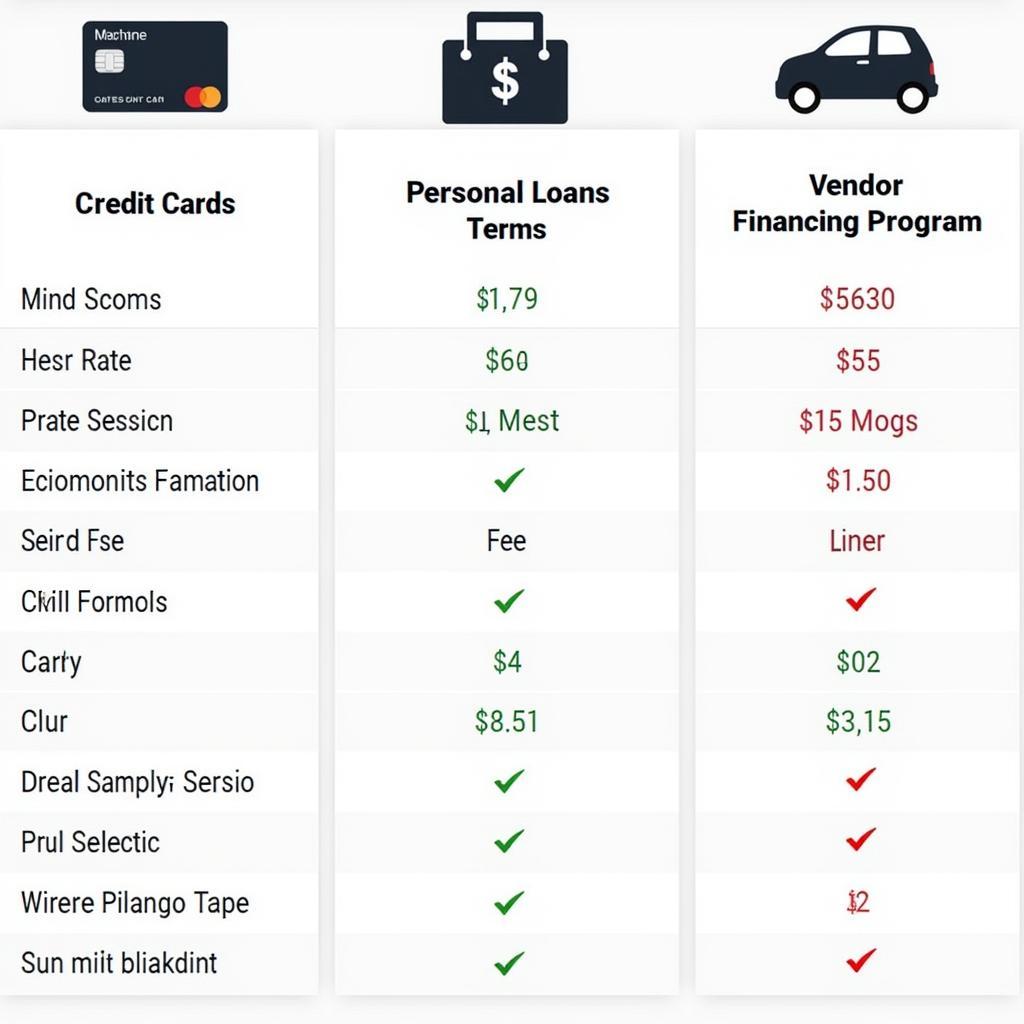

Financing a diagnostic machine means understanding your budget and available credit options. Consider how much you can comfortably afford to repay monthly. Research different financing options, including credit cards, personal loans, and vendor financing. Compare interest rates, repayment terms, and any associated fees.

Choosing the Right Diagnostic Machine

The market is flooded with various car diagnostic machines, each with its own set of features and price points. Consider factors like code reading capabilities, live data streaming, bi-directional controls, and special functions. Research reputable brands known for reliability and accurate diagnostics. Read online reviews and seek advice from fellow mechanics or car enthusiasts.

Exploring Different Brands and Models

From entry-level code readers to professional-grade scan tools, understanding the differences between brands and models is vital. Compare the features offered by different manufacturers, such as Autel, Launch, and Snap-on. Look at the supported vehicle protocols (OBD-II, CAN, etc.) and the software updates provided.

Securing Financing for Your Diagnostic Machine

Once you’ve chosen the right machine, it’s time to explore financing options. Check with the vendor to see if they offer financing plans. Compare these plans with other credit options like credit cards and personal loans. Pay attention to the interest rates, repayment terms, and any potential penalties.

Navigating Credit Applications and Approvals

Applying for credit involves providing financial information and undergoing a credit check. Ensure you understand the application process and the criteria used for approval. Be prepared to provide documentation like proof of income and identification.

“When applying for credit, it’s crucial to be transparent about your financial situation and choose a repayment plan that aligns with your budget,” says John Smith, Certified Financial Advisor at Automotive Finance Solutions.

Making the Most of Your Investment

Once you have your diagnostic machine, it’s essential to maximize its use and protect your investment. Keep the software updated to ensure compatibility with the latest vehicle models and diagnostic protocols. Consider purchasing a protective case and taking care of the hardware to prolong its lifespan.

Maintaining and Updating Your Diagnostic Machine

Regular maintenance and software updates are crucial for ensuring the accurate and efficient operation of your diagnostic machine. “Keeping your diagnostic software up-to-date is just as important as keeping your car’s engine oil changed,” advises Sarah Miller, Lead Automotive Technician at Miller’s Auto Repair.

Conclusion

Buying a car diagnostic machine on credit can be a wise investment if done carefully. By understanding your needs, researching options, and securing a suitable financing plan, you can equip yourself with a powerful tool for diagnosing and repairing vehicles. Remember to consider the long-term costs, including software updates and maintenance, when making your decision. Buying a car diagnostic machine on credit empowers you to stay ahead of the curve in automotive technology.

FAQ

- What credit score is needed to finance a diagnostic machine?

- What are the typical interest rates for financing diagnostic equipment?

- Can I get a tax deduction for buying a diagnostic machine for business use?

- What are the different types of financing available for diagnostic machines?

- What happens if I miss a payment on my financing plan?

- Can I return a diagnostic machine if I’m not satisfied with it?

- What are the warranties offered on diagnostic machines?

Suggested Questions:

- What are the best car diagnostic machines for beginners?

- How to choose the right diagnostic software for your needs?

- Tips for troubleshooting common car problems with a diagnostic machine.

Related Articles:

- Top 10 Car Diagnostic Machines for 2024

- A Beginner’s Guide to Automotive Diagnostics

- Understanding OBD-II Codes and Their Meanings

Need assistance? Contact us on WhatsApp: +1(641)206-8880, or Email: [email protected]. Our customer support team is available 24/7.