Being self-employed comes with numerous benefits, but also unique responsibilities when tax season arrives. One common question among freelancers, gig workers, and small business owners is: “Are car repair bills deductible?”. The good news is, for many self-employed individuals, the answer is yes. This article will clarify who can deduct car repair expenses, what costs qualify, and how to claim these deductions to reduce your tax burden.

Who Can Deduct Car Repair Bills?

While deducting car repairs can offer significant tax relief, eligibility isn’t universal. The following categories of individuals are typically eligible to write off car repair expenses on their tax returns:

- Self-employed individuals and small business owners: This broad category includes freelancers, independent contractors, and anyone running their own business where a car is used for business purposes.

- Gig economy and delivery drivers: If you drive for platforms like Uber, Lyft, DoorDash, or deliver for restaurants or other businesses as an independent contractor, you likely qualify.

- Armed Forces reservists: In certain circumstances, reservists may deduct unreimbursed vehicle expenses.

- Qualified performing artists: Performing artists with work-related vehicle expenses may be eligible.

- Fee-basis state or local government officials: Officials compensated on a fee basis can sometimes deduct vehicle expenses.

It’s important to note that employees who receive a W-2 form for their wages generally cannot deduct car repair expenses. These deductions are primarily for those who are self-employed and responsible for their own business expenses.

Self-employed individuals can often deduct car repair bills.

Self-employed individuals can often deduct car repair bills.

What Car Repair Expenses are Deductible?

To be deductible, car repair expenses must be considered both ordinary and necessary for your business. The IRS defines ordinary expenses as those common and accepted in your industry, and necessary expenses as those that are helpful and appropriate for your business. When it comes to your vehicle, ordinary and necessary expenses can include:

- Routine maintenance: Oil changes, tire rotations, and regular servicing to keep your car in good running condition.

- Repairs: Fixing mechanical issues, replacing parts, and addressing damage to your vehicle.

- Gas and oil: Fuel costs for business trips.

- Tires: The cost of new tires.

However, the crucial point is that these expenses must be related to the business use of your vehicle. Costs associated with personal use are not deductible.

Business use examples include:

- Driving between different work locations.

- Traveling to meet clients or customers.

- Going to business meetings.

- Delivering goods or services.

If you use your car for both business and personal purposes, as is common, you must allocate expenses based on the percentage of business use. A common method is to track business miles versus total miles driven and apply that percentage to your repair costs.

The Importance of Record Keeping

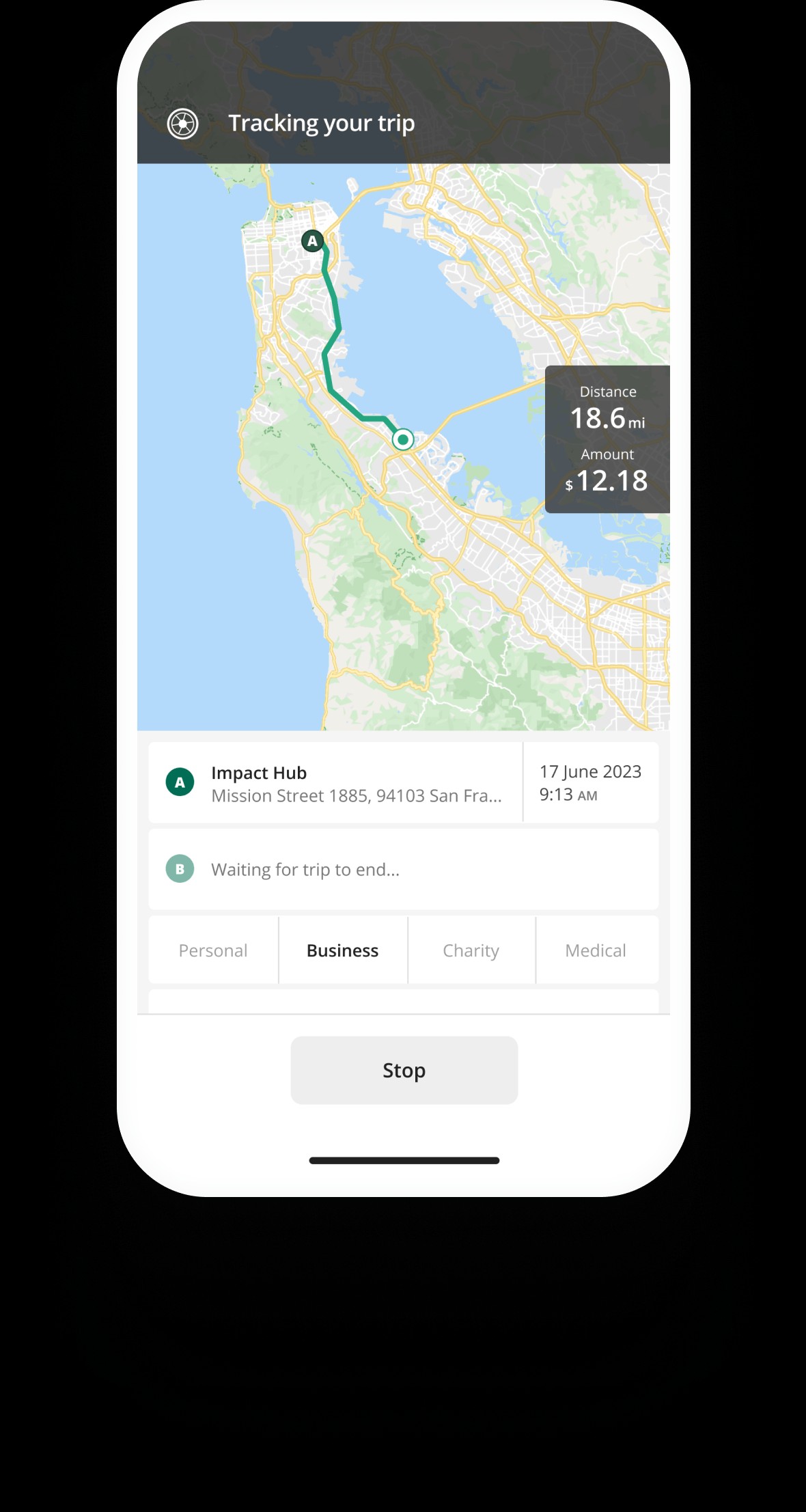

Maintaining accurate records is essential when deducting car repair expenses. You’ll need to track your business mileage throughout the year and differentiate it from personal driving. Utilizing a mileage tracking app can simplify this process, automatically recording your business miles for easy tax reporting.

How to Deduct Car Repair Expenses: Choosing a Method

There are two primary methods for deducting car expenses, including repairs, on your tax return: the standard mileage method and the actual expense method.

Standard Mileage Method

This method uses a standard IRS-set rate for each business mile driven. For example, the IRS business mileage rate was 67 cents per mile for 2024. While this rate fluctuates annually, using the standard mileage method simplifies calculations, especially if you prefer not to track every actual car expense. It’s important to note that while the mileage rate covers some operating expenses, it does not directly include repair costs as a separate deduction when using this method. The mileage rate is designed to encompass costs like gas, maintenance, and depreciation.

Actual Expense Method

The actual expense method allows you to deduct the actual costs of operating your car for business, including car repairs. This method requires you to keep detailed records and receipts for all car-related expenses, such as gas, oil, insurance, registration fees, and, importantly, repairs.

When choosing between methods, consider your situation and record-keeping preferences. For detailed guidance on selecting the best method and calculating your deductions, consulting IRS resources or a tax professional is advisable.

Where to File Your Car Repair Costs

For self-employed individuals, car repair expenses are typically deducted on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Car expenses are usually reported in Part II, Expenses, under line 22, Repairs and maintenance.

Depending on how you are reporting your vehicle expenses, you may also need to complete Part IV of Schedule C, providing details about your vehicle, such as the date it was placed in service for business and total business miles driven.

Regardless of the method you choose, always retain records of your car repairs and all other deductible expenses to substantiate your claims in case of an audit.

FAQ

Can you claim a tax deduction on car repairs?

Yes, generally, if you are self-employed and use your car for business, you can deduct car repairs as a business expense. This includes repairs, gas, oil, tires, maintenance, registration fees, parking, and tolls, but only for the portion related to business use. Personal car expenses are not deductible.

Can you write off car repairs for DoorDash or other delivery services?

Yes, as a DoorDash driver or driver for similar services, you are typically classified as an independent contractor. This means you can deduct legitimate business-related vehicle expenses, including car repairs, using either the standard mileage method or the actual expense method. Accurate record-keeping is essential to support your deductions.

In conclusion, understanding the deductibility of car repair bills is a valuable aspect of tax planning for self-employed individuals. By properly tracking expenses and understanding the available deduction methods, you can ensure you’re taking advantage of all eligible deductions and reducing your tax liability. Always consult with a tax professional or refer to IRS guidelines for personalized advice and the most up-to-date information.