Getting into a fender bender is never fun, and dealing with the aftermath can be stressful, especially when you’re facing bumper car repair costs. Luckily, financing options are available to help you manage those unexpected expenses and get your car back in tip-top shape without breaking the bank.

bumper-car-repair-cost-estimate|Bumper Car Repair Cost Estimate|An image of a mechanic in a repair shop, reviewing a cost estimate for a bumper car repair with a customer. They are discussing the different repair options and associated costs.>

Understanding Bumper Car Repair Costs

Before diving into financing options, it’s essential to understand the potential costs involved in bumper car repair. Several factors influence the overall expense, such as:

- Severity of the damage: A minor dent will cost significantly less to fix than a severely cracked bumper requiring replacement.

- Make and model of your car: Luxury or imported vehicles often come with pricier parts, impacting the repair bill.

- Type of repair shop: Dealerships usually charge more for repairs compared to independent shops.

- Location: Labor costs can vary depending on your geographical location.

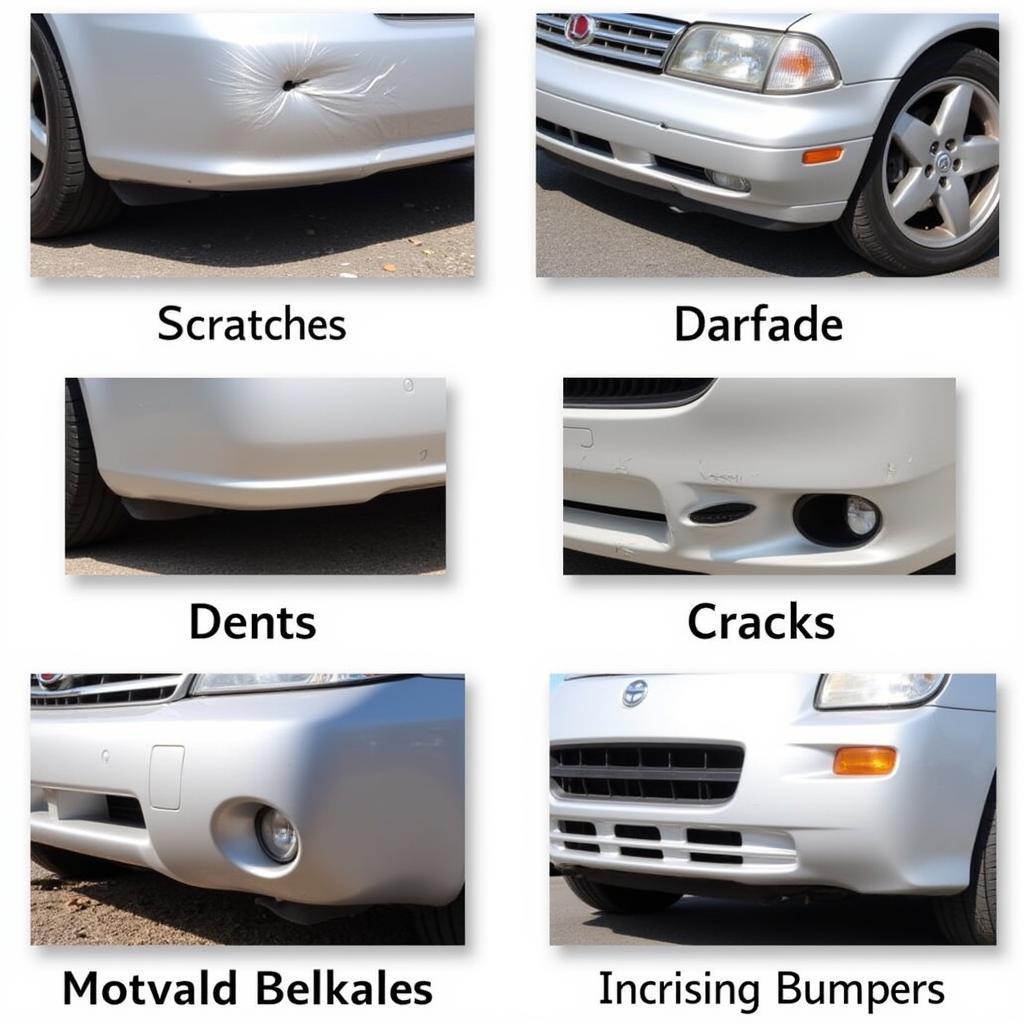

car-bumper-damage-types|Types of Car Bumper Damage|A collage showcasing different types of car bumper damage, ranging from minor scratches and dents to major cracks and bumper detachment.>

Exploring Your Bumper Car Repair Finance Options

Don’t let the fear of high repair costs deter you from getting your car fixed. Here are some common bumper car repair financing options:

- Personal Loans: Secured or unsecured loans from banks or credit unions can provide the funds needed for your repairs.

- Credit Cards: Using a credit card offers convenience, especially if you qualify for promotional interest rates or rewards programs.

- Payment Plans: Many repair shops offer flexible payment plans to help you spread out the cost over time.

- Insurance Coverage: Depending on your insurance policy and the circumstances of the damage, your insurance provider might cover a portion or even the entire cost of repairs.

“When considering financing options, it’s crucial to compare interest rates, loan terms, and any associated fees to make an informed decision,” advises John Miller, a veteran automotive finance consultant. “Don’t hesitate to contact your insurance company to understand your coverage and explore all available options before committing to any financing plan.”

Choosing the Right Financing Solution for You

With various bumper car repair financing options available, selecting the best fit depends on your financial situation and preferences:

- Good Credit Score: Individuals with a good credit history may qualify for lower interest rates on personal loans or credit cards, making these options more appealing.

- Limited Credit History: Payment plans offered directly by repair shops can be a viable option for those with limited credit history or seeking to avoid hard credit checks.

- Immediate Repairs: If you need your car fixed immediately, utilizing a credit card or securing a quick personal loan might be the fastest route.

car-repair-financing-options|Comparing Car Repair Financing Options|An infographic illustrating the pros and cons of different car repair financing options, including personal loans, credit cards, payment plans, and insurance coverage.>

Tips for Managing Bumper Car Repair Expenses

Here are some helpful tips for managing bumper car repair expenses and making the process smoother:

- Obtain Multiple Quotes: Get quotes from several repair shops to compare prices and services offered.

- Negotiate with Repair Shops: Don’t be afraid to negotiate repair costs, especially for larger repairs.

- Inquire about Discounts: Ask about potential discounts, such as those for AAA members or military personnel.

- Maintain a Car Repair Fund: Building an emergency fund specifically for unexpected car repairs can help you avoid financial strain in the future.

Conclusion

Facing bumper car repair costs can be daunting, but understanding your financing options can alleviate the stress. By exploring personal loans, credit cards, payment plans, and leveraging insurance coverage, you can find a solution that fits your budget and gets you back on the road with peace of mind. Remember to compare offers, choose a reputable lender or repair shop, and read the terms and conditions carefully before making any commitments.